Understanding the Power of Xiaohongshu for Your China Marketing Strategy

June 13, 2023

June 25, 2023

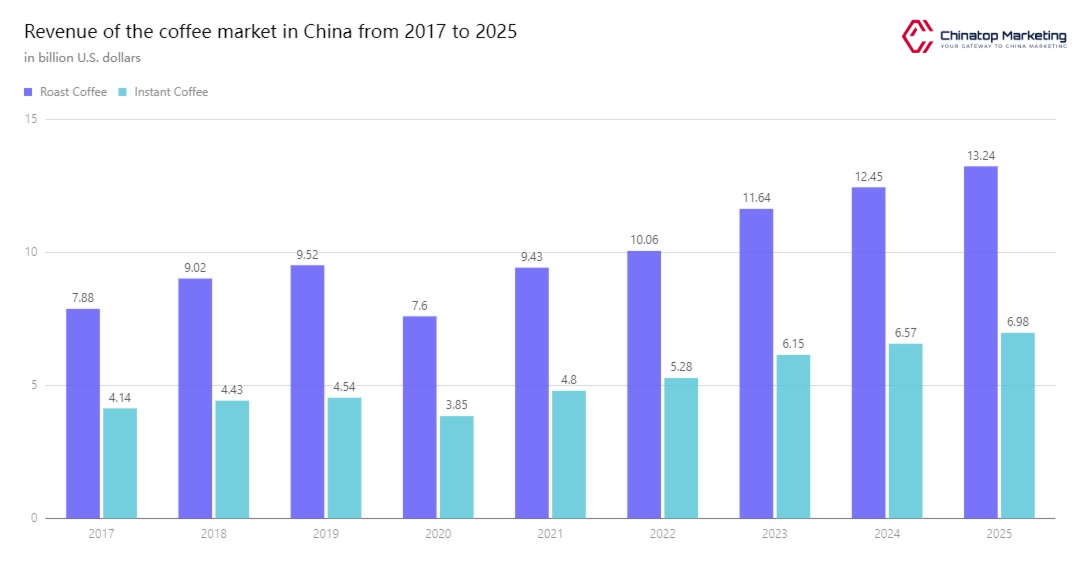

Coffee, introduced to China in the late 19th century by a French missionary, remained relatively unnoticed for a century. However, echoing the swift transformations characteristic of China, the past two decades have witnessed a remarkable shift in the market. In 2021 alone, China's coffee market experienced a staggering 31 percent growth compared to the previous year, and it is anticipated to sustain a compound annual growth rate (CAGR) of 9.63 percent from 2022 to 2025.

With China rapidly emerging as one of the world's fastest-growing coffee markets, we delve into the industry's evolution, prominent trends, and the abundant opportunities it presents.

China's coffee market overview

With the burgeoning population of coffee enthusiasts in China, the coffee market is set to generate an impressive revenue of US$15.34 billion in 2022, while the average coffee consumption per person is projected to reach 0.07kg.

Remarkably resilient in the face of the COVID-19 pandemic, the market experienced minimal disruption, with cities like Chengdu witnessing the opening of an average of one new coffee shop per day in 2020.

Consequently, coffee shops continue to proliferate nationwide, particularly in first- and second-tier cities. Furthermore, due to pandemic-related preventive measures between 2020 and 2022, many Chinese consumers have turned to enjoying coffee in the comfort of their homes, leading to a substantial surge in instant coffee sales.

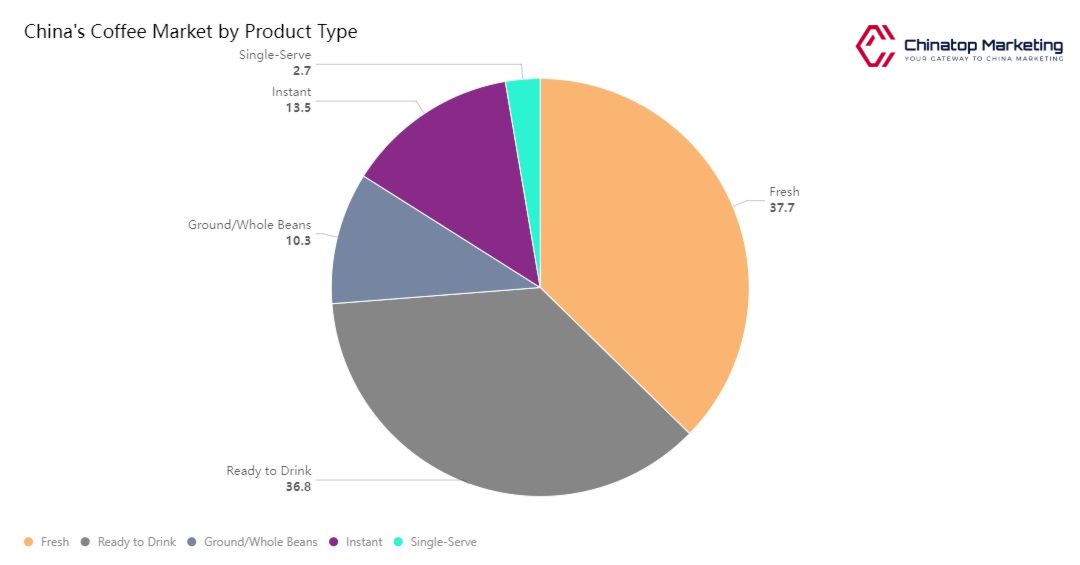

Like other countries, China's coffee market can be segmented based on product categories, including fresh coffee, single-serve options, ground or whole beans coffee, ready-to-drink (RTD) varieties, and instant coffee.

These products are distributed through various channels, such as supermarkets, convenience stores, specialty shops, and online retail platforms—a survey conducted jointly by major e-commerce player Alibaba Group Holding and food delivery platform Ele. I revealed a 1.5-fold increase in Chinese consumers purchasing coffee online since 2019.

Chinese coffee consumers are strongly inclined towards the convenience of on-the-go coffee consumption. Before Starbucks entered the Chinese market in 1999, nearly all coffee consumed in China fell into the instant or ready-to-drink (RTD) category. However, as of the conclusion of 2022, fresh coffee has secured the second position (36.7 percent) among the preferred coffee product types, closely trailing behind the persistent Chinese preference for RTD coffee (36.8 percent). This highlights the evolving tastes of Chinese consumers while emphasizing their continued affinity for convenience-driven coffee options.

Fueling China's Coffee Market: Government Policies Driving Growth and Expansion

The Chinese government has implemented a series of strategic measures and policies to foster the growth of China's coffee market.

Notably, coffee cultivation and the research and production of coffee beverages have been designated as encouraged sectors for foreign investment in the Catalogue of Encouraged Industries for Foreign Investment, the latest version released in October 2022.

Concurrently, local governments are actively promoting the development of the coffee industry, exemplified by initiatives like the I-coffee Exposition in Haikou, funded by the Chinese government. This exposition aims to advance domestic and international coffee commerce while nurturing Chinese coffee culture, focusing on coffee production, trade, and consumption.

On the production front, various departments of Yunnan's local government introduced the "Measures for Promoting the Improvement of the Rate of Fine Coffee Products and the Rate of Deep Processing" in August 2022. These measures aim to enhance the production of high-quality coffee beans in the region by 30 percent and increase the rate of intensive and deep processing of coffee by 80 percent within the next two years as part of an overarching strategy to establish Yunnan as a prominent hub for superior global coffee production.

Key components of the measures include the identification of suitable areas for coffee plantations, the introduction of new high-quality coffee varieties, the enhancement of coffee planting criteria based on regional suitability, the adoption of environmentally-friendly approaches to coffee cultivation, and the provision of financing and subsidies to support coffee plantations.

Coffee Consumption in China

Regarding coffee consumption, the Chinese market is in its early stages of development, offering substantial room for expansion compared to more mature markets in Europe and the US. While the international growth rate of coffee consumption stands at around two percent, China's coffee consumption rates have been soaring at an impressive rate of 30 percent annually. This remarkable growth trend demonstrates the immense potential for further expansion within the Chinese coffee market.

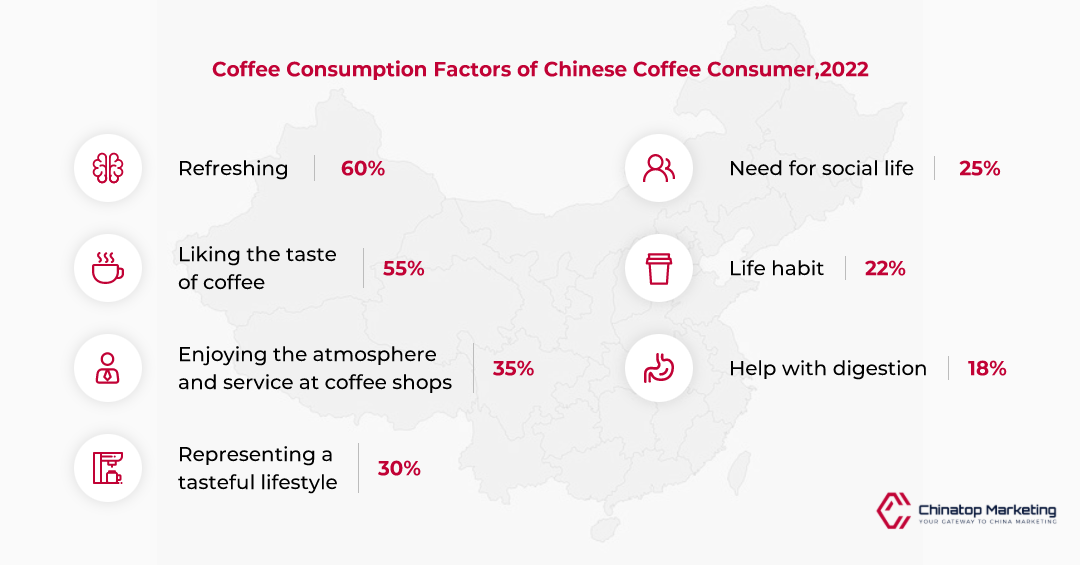

Chinese consumers have various motivations for consuming coffee, with the following factors being the primary reasons:

- A desire for a refreshing experience, prompting 53.1 percent of consumers to indulge in coffee.

- The appreciation of coffee's taste serves as a driving force for 53.2 percent of Chinese coffee enthusiasts.

- Enjoying the ambiance and service coffee shops offers attracts 31.3 percent of consumers who value the overall experience beyond just the beverage itself.

These factors collectively contribute to Chinese coffee consumers' diverse and evolving consumption patterns.

Chinese coffee consumer profile

China distinguishes itself from other major economies by lacking a robust indigenous coffee culture. Even in Japan, a nation renowned for its tea traditions, the consumption of coffee is prevalent, particularly in major urban centers. However, coffee habits in China have rapidly gained momentum, particularly among the younger generation. Similar to the distinctive characteristics that differentiate each successive generation in China, their preferences and patterns of coffee consumption also vary significantly.

Coffee consumption patterns among different age groups in China exhibit distinct characteristics. Older users (60+ years old) typically view coffee as a novelty, separate from traditional Chinese lifestyles. They may not actively seek out coffee themselves. Still, they may enjoy it in the company of family or present it as a gift.

In major cities, middle-aged consumers (40-59) have embraced coffee as a social experience rather than a product. They perceive coffee as a commodity, essential for business engagements, and a status symbol. Regularly purchasing coffee from well-known brands like Starbucks is considered a marker of financial success, as it is more expensive than local alternatives and signifies above-average earning capacity.

Millennial and Gen Z customers (people under 40) are often considered "native" coffee drinkers, as their upbringing coincided with the entry of renowned coffee companies into China. These brands have heavily influenced these younger consumers over the past two decades. Many in this category exhibit similar characteristics to coffee drinkers in mature coffee markets, reflecting the evolving coffee culture in China.

Key players in China's coffee market

Overseas Brands

As of the latest available data, foreign players dominate the Chinese coffee market, particularly in the freshly brewed coffee segment. Starbucks Coffee Company, Nestle SA, and Luigi Lavazza SPA are three prominent industry leaders, all international brands.

Starbucks entered the Chinese market in 1999, capturing the attention of millennial customers with its strong brand recognition. Over the past two decades, Starbucks has achieved remarkable success, commanding an 80 percent market share in China. With over 4,000 locations across 200 cities as of December 2019, the company aims to expand its presence to 6,000 stores by the end of 2022. Starbucks owes its immense popularity in China to a combination of factors, including offering a premium experience, adapting menu offerings to local tastes, and creating an exclusive social environment. This approach resonated with younger consumers and the emerging Chinese middle class, who sought a contemporary lifestyle accompanied by upscale surroundings.

In 2019, Starbucks and Nestlé introduced new business solutions to enhance the premium coffee experience for Chinese consumers. This collaboration resulted in the launch of 21 new products, including packaged coffees and single-serve capsule systems, extending their reach through online platforms. The strategic alliance between the two companies began in 2018 under the Global Coffee Alliance.

Italian coffee, renowned worldwide, is also significant in the Chinese market. Luigi Lavazza SPA, one of the top three players in the market, established a joint venture with Yum China in April 2020. Lavazza swiftly gained popularity among Chinese customers by launching its first flagship store outside of Italy in Shanghai. The brand's excellent Italian coffee, innovative cuisine, and the allure of Italian cultural ambiance have contributed to its success. Focusing on the growing demand for coffee in China, Lavazza has accelerated store openings and currently operates over 20 locations across the country as of 2022.

Chinese Brand

Within the Chinese coffee market, domestic players have been gaining traction in recent years, contributing to the evolving coffee culture in China. Although facing tough competition from international brands, Chinese coffee companies have made significant strides in product quality and marketing strategies. As of 2022, the domestic market remains fragmented, with numerous emerging brands and a few key competitors.

Among the prominent Chinese coffee brands, Luckin Coffee and Coffee Box dominate the quick pick-up and delivery segment. Luckin Coffee, a technology-driven company, entered the market in 2018 and quickly expanded its presence, utilizing centralized technology systems to gauge consumer demand and enhance productivity.

Initially developed as a coffee delivery software, Coffee Box ventured into its brand in 2016. Leveraging consumer preferences and demographics insights, Coffee Box established small coffee shops, or "stations," with a small team of baristas and delivery workers. Social media platforms like WeChat and meal delivery apps like Meituan contribute significantly to Coffee Box's order volume.

Pacific Coffee, originally founded in Hong Kong in 1992, entered the mainland Chinese market in 2011. After selling an 80 percent ownership stake to China Resources Enterprise, Pacific Coffee has expanded its presence across different countries, aiming to establish 1,000 locations in mainland China.

Manner Coffee, which began as a roadside stand in Shanghai in 2015, garnered attention for its smooth flat whites, stylish decor, and affordable pricing. Specifically targeting a younger audience, Manner positioned itself as an environmentally friendly brand, offering discounted prices for customers who brought their cups. With an investment of US$12 million from Today Capital, Manner expanded nationwide in 2019, opening new locations in various cities and becoming one of China's recognizable coffee brands.

Seesaw Coffee, founded in 2012, has emerged as a major consumer of specialty-grade coffees from Yunnan province. The Chinese specialty coffee roaster and retailer recently secured a significant investment of RMB 100 million (about US$15.4 million) from boutique tea chain HeyTea and its shareholders, facilitating further expansion for the brand.

These Chinese coffee brands exemplify the growth and diversity within the domestic market, contributing to the expanding coffee culture and appealing to the preferences of Chinese consumers.

China's evolving coffee industry: Reducing Dependence on foreign coffee beans

China's dependency on foreign coffee beans has decreased as the domestic coffee industry has grown and developed. Initially, China relied heavily on imported coffee beans to meet the country's rising coffee demand. However, in recent years, there has been a significant increase in domestic coffee production.

China's coffee cultivation has expanded, particularly in regions like Yunnan Province, which has a favorable climate and conditions for coffee farming. The government has also implemented initiatives to promote coffee cultivation, encouraging investment in coffee plantations and the development of high-quality coffee beans.

Furthermore, domestic coffee companies have been actively working to improve the quality of locally produced coffee beans. They have invested in modern farming techniques, processing facilities, and expertise to enhance the flavor and consistency of Chinese-grown coffee.

While China still imports a portion of its coffee beans to cater to diverse consumer preferences and maintain access to specialty varieties, the growth of the domestic coffee industry has reduced the country's reliance on foreign coffee beans. The increasing availability of high-quality Chinese coffee beans has contributed to the country's self-sufficiency and decreased import dependency.

Overall, China's coffee industry has made significant strides in becoming more self-sustainable and reducing its reliance on foreign coffee beans, demonstrating the growth potential of the domestic coffee market.

Exploring Lucrative Prospects: Key Segments and Growth Opportunities for Foreign Brands

Opportunities for foreign players in key segments of China's coffee market are abundant as the industry undergoes significant transformations and consumer preferences evolve. One notable trend is the increasing popularity of coffee consumption among Gen Z consumers and younger generations, particularly in larger cities. These demographics are driving the growth of the coffee market and shaping its dynamics, making them a crucial target for foreign players.

Chinese consumers are strongly inclined towards social settings and value the experience associated with coffee consumption. Coffee shops are popular gathering spots where friends and colleagues meet, making them integral to the coffee culture. As living standards rise and the younger generations seek new experiences, coffee shops continue to flourish, presenting lucrative opportunities for foreign brands to establish a strong presence in the market.

Ready-to-drink products have emerged as a significant favorite among Chinese consumers. The convenience and portability of these beverages cater to the busy and on-the-go lifestyle of urban dwellers. Capitalizing on the demand for ready-to-drink coffee presents a promising avenue for foreign players to capture a sizable market share.

In the wake of the pandemic, as the economy reopens and restrictions ease, the coffee market is expected to experience a surge in activity. Coffee shops will play a vital role in providing a space for people to socialize, relax, and enjoy their favorite brews. This post-pandemic opening up presents a prime opportunity for foreign coffee chains to expand their footprint and capitalize on the pent-up demand for coffee shop experiences.

Digitalization has become an integral part of the Chinese market, and the coffee industry is no exception. Online retailing is indispensable for building brand awareness, reaching a wider customer base, and facilitating rapid growth. Leveraging e-commerce platforms and digital marketing strategies can significantly enhance a foreign brand's visibility and accessibility in the Chinese coffee market.

Importing coffee beans remains a critical aspect of the industry, as China's domestic coffee production is still in its early stages. The demand for high-quality coffee beans continues to rise, offering opportunities for foreign suppliers to cater to the growing market needs. Establishing strong supply chains and partnerships with local distributors can ensure a steady and reliable source of coffee beans for foreign players.

As the coffee market extends beyond major cities and penetrates deeper into China's regions, foreign companies have the potential for long-term growth and success. By understanding evolving consumption patterns, embracing digitalization, and catering to the preferences of younger generations, foreign players can position themselves as key contributors to the development of China's coffee culture and capitalize on the country's expanding coffee market.

For those interested in selling their coffee or coffee beans in China, we offer tailored marketing solutions that can ensure remarkable success in this thriving and sustainable industry. Reach out to us promptly, and we will provide you with top-notch marketing strategies to effectively position your products and achieve outstanding results in the Chinese market. Our high-quality solutions are designed to meet Chinese consumers' unique demands and preferences, enabling you to establish a strong presence and unlock the full potential of this lucrative industry.