Understanding the Power of Xiaohongshu for Your China Marketing Strategy

June 13, 2023

June 26, 2023

With China emerging as the world's second-largest cosmetics market and the rapid rise of Chinese social media platforms, foreign brands are finding it increasingly favorable to penetrate and thrive within the country's thriving beauty industry.

As Chinese consumers continue to exhibit a strong affinity for overseas cosmetics products, the expanding market insights indicate a remarkable growth trajectory: China's cosmetics market achieved a staggering 6 billion yuan in retail sales revenue in 2022, and experts foresee this upward trend continuing due to the escalating demand for cosmetics and skin care products in second and third-tier cities.

Moreover, surpassing domestic alternatives, over half of the Chinese beauty consumers prefer international brands. Notably, the cosmetics industry is witnessing a surge in demand from Chinese male consumers, projected to reach a market size of approximately 24 billion yuan by 2027.

If you're intrigued by the ever-evolving Chinese market, join us as we delve into the latest cosmetics trends and explore effective marketing strategies to captivate the local clientele and drive sales of your beauty products.

Exploring the Vast Dimensions of China's Cosmetic Market

In China, the cosmetics industry encompasses a wide array of products that cater to the needs of cleansing, grooming, and enhancing the human face and body. It includes skincare sets, color cosmetics, hair care, and toiletries. Today, the cosmetics sector is one of China's most promising and rapidly expanding business segments.

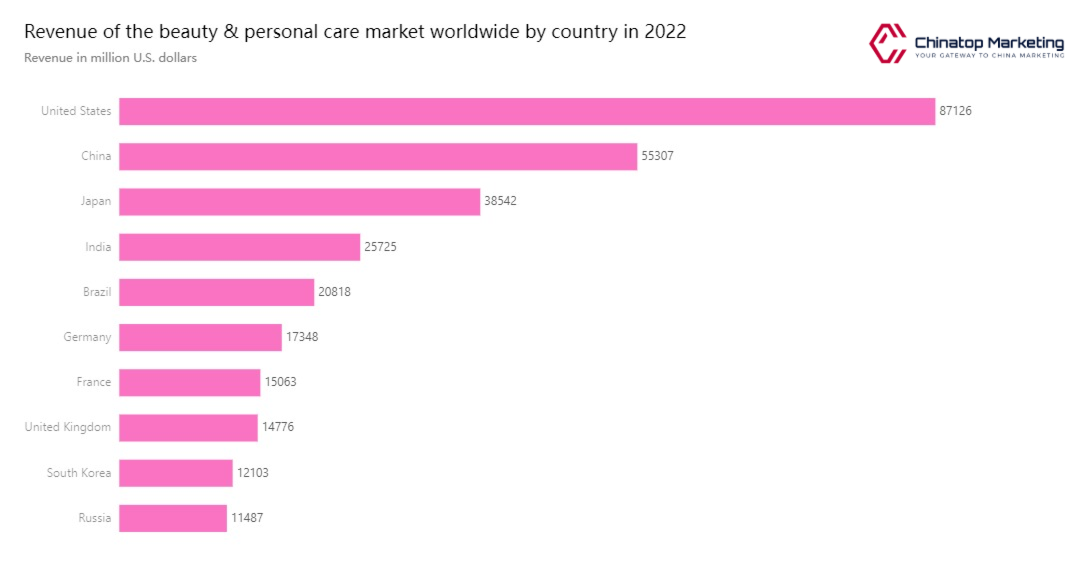

In 2022, propelled by urbanization, increasing disposable income, and the pervasive influence of social media, China emerged as the world's second-largest market for beauty and personal care products, following the United States. This transformative landscape is witnessing a remarkable surge in demand for premium, higher-quality brands, presenting significant opportunities for growth and success.

Also, Chinese consumers generally exhibit a strong preference for overseas cosmetics. More than half of Chinese beauty consumers prefer international brands over domestic ones. This preference for foreign cosmetics can be attributed to various factors, including perceived higher quality, innovative formulations, brand reputation, and the association of international brands with prestige and luxury. Global beauty trends also influence Chinese consumers, who often seek out products that are popular and well-regarded in other countries. This preference for overseas cosmetics presents a significant opportunity for international brands to enter and flourish in the Chinese market.

Decoding Cosmetic Regulation in China: Ensuring Compliance and Safety

Cosmetics in China are regulated by the China National Medical Products Administration (NMPA) under the overarching framework of the Cosmetics Supervision and Administration Regulation (CSAR). The regulatory process in China for cosmetics involves several key steps:

1. Product Registration: Before cosmetics can be sold in China, they must be registered. Both domestic and imported cosmetics must be registered with the NMPA or its local counterparts. This process involves submitting detailed information about the product, including ingredient lists, product specifications, safety data, and efficacy claims.

2. Animal Testing: Historically, animal testing was a mandatory requirement for cosmetics registration in China. However, as of May 1, 2021, a significant policy change was implemented. Certain cosmetics, such as those manufactured in China, must no longer undergo animal testing. However, certain products like hair dyes and sunscreens still undergo mandatory animal testing. At the same time, imported cosmetics are subject to post-market testing.

3. Safety Assessment: The NMPA conducts safety assessments to ensure the cosmetics meet safety standards and do not pose significant consumer risks. It includes evaluating the safety of ingredients used, their concentrations, potential toxicity, and any potential risks associated with product use.

4. Labeling and Claims: Cosmetics sold in China must adhere to specific labeling requirements, including mandatory information in Chinese on the product label and packaging. The NMPA regulates claims made by cosmetics, ensuring they are accurate, substantiated, and do not mislead consumers.

Companies entering the Chinese cosmetics market must familiarize themselves with the specific regulatory requirements and seek guidance from local experts or consultants to ensure compliance with the latest regulations.

Market Share of Chinese E-Commerce Platforms

The surge of e-commerce platforms in mainland China witnessed a remarkable shift in the cosmetics retail landscape, with approximately 84.2% of total cosmetics sales in 2020 being generated through online channels. It marked a significant increase from the previous year's 78%.

Concurrently, Chinese cosmetics products captured a notable share of 6.24% in the overall online retail sales of the country. These figures underscore the unwavering purchasing power of Chinese beauty consumers online and highlight the accelerated growth of China's e-commerce beauty industry, further fueled by the coronavirus pandemic 2020.

In China, several mainstream sales platforms dominate the e-commerce landscape and play a significant role in the cosmetics retail sector.

1. Tmall: As operated by Alibaba Group, Tmall is one of China's largest business-to-consumer (B2C) platforms. It hosts a wide range of brands, including both domestic and international cosmetics companies. Tmall offers a trusted and well-established platform for brands to reach Chinese consumers.

2. JD.com: JD.com, also known as Jingdong, is another major B2C e-commerce platform in China. It boasts a vast selection of products, including cosmetics and beauty items. JD.com focuses on providing reliable delivery and high-quality customer service.

3. Taobao: Also owned by Alibaba Group, Taobao is a popular consumer-to-consumer (C2C) platform in China. While it is known for its diverse range of products, including cosmetics, Taobao offers opportunities for smaller businesses and independent sellers to showcase their products.

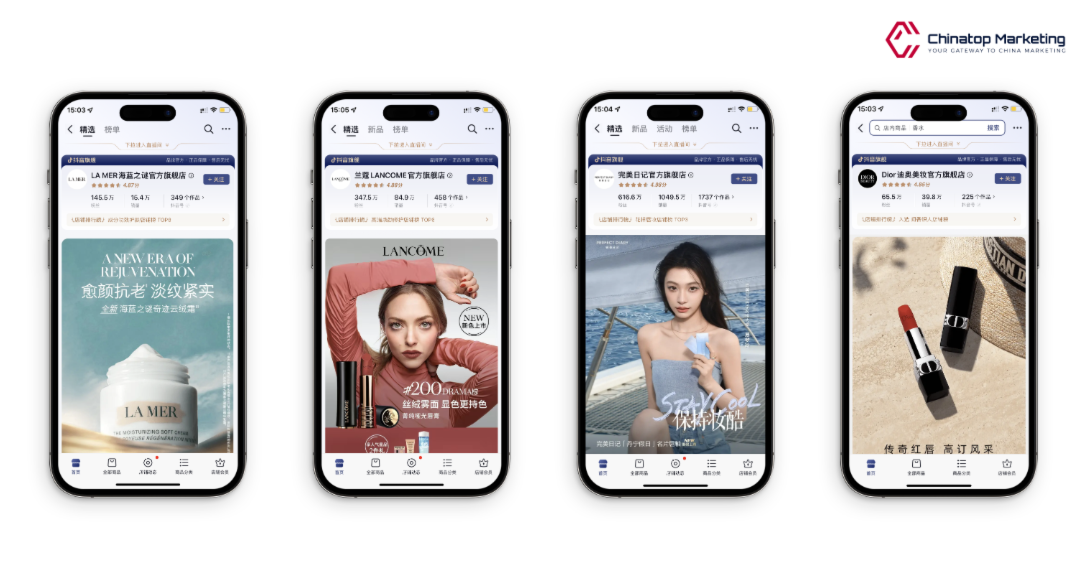

4. Xiaohongshu (Little Red Book): Xiaohongshu is a popular social e-commerce platform that combines user-generated content with shopping. It has gained a significant following among young Chinese consumers, who use the platform to discover and review cosmetics products.

5. Douyin (TikTok): Douyin, known as TikTok internationally, is a short-video platform with a massive user base in China. It has expanded into e-commerce, allowing brands to promote and sell cosmetics products through in-app features.

6. WeChat Mini Program: WeChat, a widely used social media and messaging app in China, has its mini-program ecosystem. Brands can leverage WeChat mini-programs to create customized shopping experiences and engage with customers directly.

These platforms and several others provide extensive reach and access to the Chinese market, enabling cosmetics brands to connect with a large customer base and tap into the thriving e-commerce ecosystem in China.

Why is China's cosmetics market on the rise?

China's cosmetics market continues to experience significant growth, driven by various factors and sub-sectors:

Chinese Cosmetics Online Shop Over Physical Store: The preference for online shopping in China has also extended to cosmetics. Chinese consumers increasingly favor online platforms, such as Tmall, JD.com, and Taobao, to purchase their cosmetics products. The convenience, extensive product options, and competitive pricing offered by e-commerce platforms have propelled the dominance of online sales over physical stores.

Rising Market Size of Perfume and Fragrances: The market for perfume and fragrances in China has experienced substantial growth in recent years. As Chinese consumers increasingly appreciate personal aromas, the demand for perfumes and fragrances has increased. Both domestic and international brands are tapping into this expanding market by offering diverse scents to cater to different preferences.

The Cosmetics Market for Male Consumers: The cosmetics industry in China has witnessed a surge in demand from male consumers. Men are becoming more conscious of their appearance and skincare needs, leading to a growing market for male grooming and beauty products. Brands are capitalizing on this trend by introducing tailored products and marketing campaigns to cater to the male consumer segment.

The Rise of the Skincare Market: Skincare products have gained immense popularity among Chinese consumers, driving significant growth in the skincare market. With a growing focus on skincare routines and a desire for healthy and radiant skin, consumers are increasingly investing in skincare products, including cleansers, moisturizers, serums, and masks.

These factors, combined with the broader drivers such as increasing disposable income, urbanization, social media influence, preference for overseas brands, self-expression trends, product innovation, and the shift towards online retail, have contributed to China's cosmetics market's overall growth and dynamism.

What Drives Chinese To Buy Cosmetics?

Several factors drive Chinese consumers to buy cosmetics:

Beauty and Self-Expression: Chinese consumers are increasingly conscious of their appearance and seek products that enhance their beauty and self-expression. Cosmetics allow individuals to express their personality, boost confidence, and desirably present themselves.

Influence of Social Media and KOLs: Chinese consumers are highly influenced by social media platforms such as WeChat, Weibo, Xiaohongshu, and Douyin (TikTok). Key Opinion Leaders (KOLs) and influencers are crucial in shaping consumer preferences and promoting cosmetics through product reviews, tutorials, and recommendations.

Skincare and Health Consciousness: Skincare is a significant focus for Chinese consumers. They prioritize products promoting healthy skin and address concerns like anti-aging, brightening, and hydration. Consumers increasingly seek natural and organic formulations and products with scientifically proven benefits.

Personal Care and Well-being: Cosmetics and personal care products are essential for maintaining good hygiene, grooming, and overall well-being. Chinese consumers value products that enhance their daily routines and contribute to their self-care rituals.

Gifting Culture: In China, cosmetics are popular for gifting on special occasions like holidays, birthdays, and festivals. Buying cosmetics as gifts is seen as a way to show care and thoughtfulness and enhance personal relationships.

Online Shopping Convenience: The convenience and accessibility of online shopping platforms have significantly influenced Chinese consumers' purchasing behavior. E-commerce platforms offer a wide range of cosmetics products, competitive pricing, and convenient delivery options, making it easier for consumers to explore and buy their preferred brands.

These driving factors collectively shape the purchasing behavior of Chinese consumers and contribute to the growth and vibrancy of the cosmetics market in China.

Conclusion

For cosmetics brands aiming to thrive in China's rapidly growing market, it is crucial to capitalize on the opportune moments and shopping festivals. Equally important is partnering with influential figures who can effectively promote your beauty products and generate positive attention in China.

With over 13 years of experience in digital marketing tailored to the Chinese market, Chinatop Marketing is well-equipped to assist your cosmetics and beauty brand in successfully entering and expand within China's cosmetics market. Our seasoned consultants are ready to collaborate with you in developing a tailored strategy that aligns with your brand's objectives in China. Please share more details about your project, and let us help you navigate the dynamic landscape of China's cosmetics industry.