Understanding the Power of Xiaohongshu for Your China Marketing Strategy

June 13, 2023

June 28, 2023

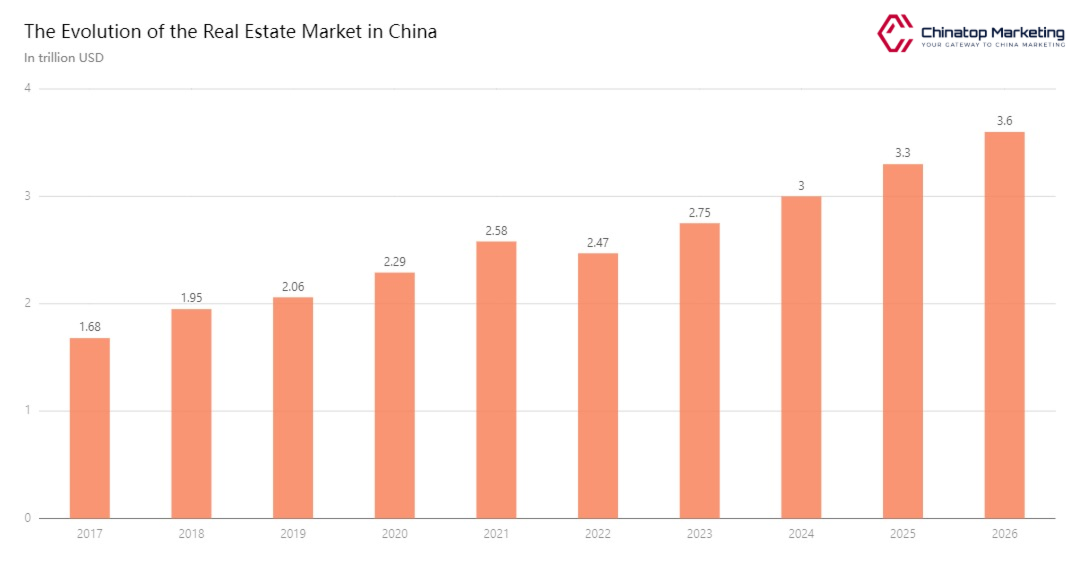

The Chinese real estate industry, a vital pillar of the country's economy, plays a substantial role in driving its GDP forward, encompassing a significant portion of its overall economic output. This robust sector has demonstrated consistent growth over the years, owing to the continuous support and encouragement from the government, coupled with the implementation of market liberalization policies. As we look ahead to 2023, it is projected that the total revenue generated by China's expansive real estate market will reach an impressive $2.73 trillion, a testament to its formidable presence and influence.

Given China's expansive geographical expanse and extensive urbanization, the intricacies and dynamics of the real estate industry in China diverge significantly from those observed in Western nations such as the United States and Canada, making it a distinctive and fascinating entity to study and comprehend.

China's Real Estate Market Unveiled: A Comprehensive Overview of Opportunities and Trends

China's real estate market stands as a colossal entity on the global stage, boasting a staggering number of developers, over 2.9 million employees, and a remarkable tenfold surge in real estate sales revenue since 2005.

Over the past decade, housing prices in China have witnessed an exponential doubling, with the average sale price per square meter skyrocketing from 3.8 thousand yuan in 2008 to a staggering nine thousand yuan in 2019, reflecting diverse price growth trends across different regions, with Beijing and Shanghai leading the pack in terms of sales prices.

As China's urbanization continues to surge, accompanied by a rising GDP per capita, the constant demand for new housing persists, propelling housing prices to escalate at a pace akin to GDP per capita. However, for some, the dream of owning an apartment remains elusive.

Viewed as a lucrative investment opportunity, real estate holds immense appeal for many Chinese individuals, who allocate a significant portion of their savings to this sector. At the same time, the government itself recognizes the paramount importance of the real estate market and its profound impact on the overall economy.

Indispensable to China's economic landscape, the real estate sector is a crucial revenue generator for local governments through land sales. At the same time, banks remain actively involved by issuing many property-related loans.

Recognizing the market's significance in ensuring economic stability, the government has undertaken concerted efforts to stabilize the real estate market and foster sustainable growth.

What are the underlying factors behind the soaring housing prices in China?

The high housing prices in China can be attributed to a combination of various factors, including but not limited to:

Supply and Demand Imbalance: Rapid urbanization and population growth have increased the demand for housing in China. The supply of housing, however, has struggled to keep up with this demand, leading to a shortage of affordable housing options.

Land Scarcity and Regulations: Limited availability of land in desirable urban areas puts additional pressure on housing prices. Government regulations, such as land use and development restrictions, can further contribute to the scarcity of land and drive up prices.

Speculation and Investment Behavior: Real estate has long been viewed as a secure investment in China, leading to a culture of property speculation. Many individuals invest a significant portion of their savings in real estate, considering it a means of preserving and growing wealth. Such investment behavior can inflate housing prices.

Economic Growth and Rising Incomes: China's rapid economic growth and increasing GDP per capita have increased incomes for many citizens. As people's purchasing power increases, they are willing to spend more on housing, which can drive prices higher.

Government Policies and Interventions: The Chinese government has implemented measures to stimulate the real estate market and support economic growth. However, some of these policies, such as easy access to credit and favorable lending conditions, have inadvertently contributed to rising housing prices.

Does Covid-19 have an impact on Chinese real estate sales?

COVID-19 has had a significant impact on Chinese real estate sales. The pandemic caused disruptions across various sectors, including real estate, due to implementation of lockdown measures, travel restrictions, and economic uncertainties.

Temporary Decline in Sales: During the initial stages of the pandemic, real estate sales in China experienced a temporary decline as people hesitated to make large financial commitments amidst the uncertainties surrounding the virus and its impact on the economy.

You Slowed Construction and Project Delays: Lockdown measures and supply chain disruptions resulted in construction delays and project suspensions, affecting the availability of new housing units for sale.

A shift in Consumer Preferences: The pandemic changed consumer preferences and priorities. Homebuyers started seeking properties with more spacious layouts, home offices, and outdoor spaces as remote work and stay-at-home measures became prevalent. This shift in demand influenced the types of properties being sought, impacting sales in certain market segments.

Acceleration of Digitalization: To adapt to social distancing measures, real estate agents and developers increasingly turned to digital platforms for property marketing, virtual tours, and online transactions. The digitalization of real estate sales became more prominent during the pandemic.

Government Interventions: The Chinese government introduced various policies and measures to stabilize the real estate market and stimulate economic recovery. These included reducing interest rates, relaxing mortgage requirements, and providing financial incentives to homebuyers to boost real estate sales.

It is important to note that the impact of COVID-19 on Chinese real estate sales varied across regions and over time as the situation evolved and containment measures were implemented and lifted.

Growing Investment In Foreign Real Estate

Investment in foreign real estate has grown as individuals and businesses seek opportunities outside the domestic market. Several factors have contributed to this trend, including portfolio diversification, the potential for higher returns, international business expansion, and personal reasons such as lifestyle choices or second home investments.

Several countries have become popular choices for foreign real estate investors regarding preferred investment locations.

United States: The United States has always been a favored investment location for foreign real estate buyers. Major cities such as New York, Los Angeles, Miami, and San Francisco, as well as popular regions such as Florida and California, have attracted significant investment due to their strong market stability, potential for capital appreciation, and vibrant rental markets.

United Kingdom: The United Kingdom, especially London, has long been an attractive destination for foreign real estate investment. The city's global financial center status, cultural appeal, and stable real estate market make it an attractive option for long-term growth and rental income investors.

Canada: Canada's real estate market is popular with foreign investors, especially in Vancouver, Toronto, and Montreal. A strong economy, political stability, and multicultural environment make it an attractive investment destination.

Australia: Australia's major cities, including Sydney, Melbourne, and Brisbane, have attracted substantial foreign real estate investment. The country's stable economy, quality of life, and growing population enhance its attractiveness as an investment location.

Germany: Germany, especially cities such as Berlin, Munich, and Frankfurt, has become an attractive destination for foreign real estate investment. The country's strong economy, favorable rental market conditions, and strong legal framework make it an attractive option for investors looking for stable returns.

Preferred investment locations may vary depending on individual investor preferences, economic conditions, market trends, and government regulations. Investors often conduct in-depth research and seek expert advice to determine the most suitable investment opportunities in foreign real estate markets.

How to get close to the Chinese real estate investor?

To get close to Chinese investors, it is important to understand their culture and business practices while implementing effective strategies to establish connections.

Cultivate Relationships: Chinese business culture emphasizes the significance of personal relationships or guanxi. Invest time building rapport and trust by attending networking events, industry conferences, and business forums where you can interact with Chinese investors. Developing personal connections and maintaining regular contact is crucial in building long-term relationships.

Seek Local Partnerships: Collaborating with local partners with connections and expertise in the Chinese market can significantly enhance your access to Chinese investors. Local partners can provide valuable insights, assist with cultural nuances, and act as intermediaries to bridge the gap between you and potential investors.

Understand Chinese Culture and Etiquette: Familiarize yourself with Chinese culture, customs, and business etiquette. Displaying respect for Chinese traditions, such as exchanging business cards with both hands and addressing individuals by their proper titles, demonstrates your cultural sensitivity and can make a positive impression.

Leverage Online Platforms: Chinese investors are highly active on digital platforms such as WeChat, Weibo, and other social media channels. Establish an online presence through these platforms, share relevant industry insights, engage with potential investors, and showcase your expertise to generate interest and gain visibility.

Engage in Chinese Business Events: Participate in trade shows, investment forums, and business exhibitions targeted at Chinese investors. These events provide opportunities to network, pitch your investment offerings, and gain exposure to a wider audience of potential investors.

Engage Professional Intermediaries: Engaging professionals, such as investment advisors, consultants, or law firms with expertise in cross-border transactions involving Chinese investors, can help facilitate introductions and navigate the complexities of the Chinese market.

Adapt Marketing Strategies: Tailor your marketing materials, presentations, and documentation to appeal to Chinese investors. This may include translating materials into Mandarin, highlighting key investment benefits, and clearly understanding your investment proposition in the Chinese market.

Remember, building relationships takes time and patience. Demonstrating a genuine interest in understanding Chinese investors' needs, respecting their culture, and establishing trust is essential for successful connections in the Chinese investment community.

So, How to build strong trust with Chinese investors?

A comprehensive strategy incorporating various elements can effectively build strong trust with Chinese investors.

Establish a WeChat Official Account: WeChat is an essential platform in China for business communication and networking. Creating a WeChat Official Account allows you to share valuable content, industry insights, and updates with potential investors. Regularly engaging with your audience through WeChat can demonstrate your expertise and commitment to providing useful information.

Create a Chinese Landing Page: Having a dedicated landing page in Chinese can enhance your credibility and cater to the preferences of Chinese investors. This page should include relevant information about your company, investment offerings, team profiles, and contact details. Ensuring accurate translations and localized content will resonate with Chinese investors and make it easier for them to understand your business.

Implement Baidu SEO Strategies: Baidu is the leading search engine in China. Optimizing your online presence for Baidu SEO (Search Engine Optimization) can significantly improve your visibility and reach among Chinese investors. This involves researching keywords, optimizing website content, and obtaining quality backlinks from reputable Chinese websites.

Collaborate with Key Opinion Leaders (KOLs): Key Opinion Leaders, or influential individuals with a strong following on social media platforms, can help build trust and credibility. Partnering with relevant KOLs in your industry can amplify your brand message and reach a wider audience of potential investors. KOLs can provide endorsements, share testimonials, and facilitate introductions, enhancing your reputation among Chinese investors.

Create Official Social Media Accounts: Establishing official accounts on popular Chinese social media platforms like Weibo and Douyin (known as TikTok outside China) allows you to connect with a broader audience. Regularly posting engaging content, responding to comments, and sharing updates about your company's activities can foster trust and authenticity.

Provide Genuine Company Information: Chinese investors value transparency and authenticity. Ensure that your company information is accurate, up-to-date, and easily accessible. This includes providing clear details about your company's background, team members, financial performance, and any regulatory approvals or certifications you have obtained.

Foster Real Cooperation and Partnerships: Actively seek opportunities for genuine cooperation and partnerships with Chinese entities. Collaborating with reputable Chinese businesses, industry associations, or investment platforms can significantly enhance your credibility and trustworthiness in the eyes of Chinese investors.

Building trust takes time, consistency, and a genuine commitment to providing value and building relationships. Combining strategies like WeChat Official Accounts, Chinese landing pages, Baidu SEO, collaborations with KOLs, and authentic social media presence can establish a strong foundation of trust with Chinese investors.

China Real Estate Sector Guide: Summary

The Chinese real estate market presents immense opportunities for growth and profitability. Still, fierce competition demands a proactive approach beyond relying solely on sales agents.

To establish a strong presence and cultivate a reputable brand, serious players should prioritize investing in their online growth. Engaging a native agent who deeply understands the Chinese market can effectively attract new consumers and drive long-term success. Opting for an in-house team over a third-party sales agent is highly advantageous.

At our China-based marketing agency, we specialize in providing cost-effective solutions tailored to foreign brands seeking to penetrate the Chinese market. With our team of seasoned Chinese and foreign experts, we possess the essential experience and expertise necessary to navigate this dynamic and complex market, ensuring your brand's triumphant journey.

With a solid track record of 13 years in the marketing industry, Chinatop Marketing is your trusted partner. Collaborating with us can streamline your operations in China and minimize unnecessary expenses. Our expertise is seamlessly connecting you with potential investors in the Chinese market, ensuring your brand's success and growth.